Reading Time - 8 Minutes

It is one of the words that every trader has come across at

some point. However, very few actually understand what it is or how it works.

In this blog post I am going to look at specifically the new rules on leverage

proposed by ESMA (European Securities and Markets Authority). We will look at the differences the changes will make and

also show who it will hit hardest.

I am sure if you are with a broker anywhere in Europe, you

have received somewhat panic-stricken emails from the broker, urging you to

email ESMA and show your opposition to the new leverage restrictions they are

suggesting. Your broker isn’t doing that because they care about you and want you

to always have the best they can offer – they are emailing you because the new

regulations would cost the brokers money in loss of business.

So, the first thing to say is that I would be VERY surprised

if the new regulations don’t come into force. The EU write their own rules with

very little care for the opinion outside of their bureaucracy. Sometimes I

think their departments make new regulations simply to justify their jobs… can

you spot my disdain for them yet?

However, there does need to be a change within the trading

industry. You can get leverage as high as 1:200, which is frankly ridiculous.

What it does is inspire gambling and leads to a lot of beginners losing a lot

of money. It is easy to quick-fire orders on a market when you are in a downward

spiral of emotional trading, and with such high leverage, your broker will only

margin call your account when it is almost completely cleaned out.

The brokers themselves do not care, and so it had to come to

some regulatory board to bring about changes. I do think as an adult, you

should shoulder the full responsibility of your decisions and be able to MAKE

those decisions without big-brother looking over your shoulder. You risked the

money. You lost the money. It is your own fault. But the changes are almost

certainly coming, and there will actually be some benefits and safeguards that

it will bring about.

So, who is this going to hurt and who isn’t it going to

hurt?

Mainly it is going to hurt those with small trading

accounts. It is going to force you to reduce your risk on trades, like it or

not. It may even price some people out of the markets… But, is that a bad

thing? If you are risking extremely high amounts in terms of a percentage of

your overall account, you are going to blow your account anyway. It happens

every single time. If you are looking to build a career or a serious secondary

income source, you need to use strict money management. The new leverage rules

will force you to be somewhat safer with your money.

Mainly it is going to hurt those with small trading

accounts. It is going to force you to reduce your risk on trades, like it or

not. It may even price some people out of the markets… But, is that a bad

thing? If you are risking extremely high amounts in terms of a percentage of

your overall account, you are going to blow your account anyway. It happens

every single time. If you are looking to build a career or a serious secondary

income source, you need to use strict money management. The new leverage rules

will force you to be somewhat safer with your money.

What about those who can’t afford to open an account and

trade with the new leverage levels? Again, is that really that bad? If you

can’t afford to put say a couple of thousand in an account, should you even be

trading? People may get outraged but being able to trade at 1:200 is crazy. It

will force people onto a demo account until they can build money enough to open

a live account. In that time, people can learn whilst safe from blowing a real

account.

It is also going to hurt swing traders or anyone who has

multiple positions open at once. Trying to hold 5 – 10 positions at once will

require a much larger account to cover the margin requirements. We are going to

look at some examples shortly.

Who isn’t it going to hurt as much? Well, us day traders who

use good money-management. If you are risking small amounts of your capital,

say 1% - 3% then the new leverage will not have such a profound impact. As a

day trader, I only ever have 1 position open at a time, and on very rare

occasions, two. Again, that protects me from the new changes. But really, it

protects me from huge losses, which is the real reason I do it, and the real

reason all professionals do it.

Let’s look at a couple of examples on the FTSE 100 and

EURUSD using IG Index broker. Currently, they offer up to 1:200 leverage.

However, with the new proposals, major markets may drop down to 1:30.

The amounts we will use can be reduced slightly by using

tight stops, but for the purpose of this blog we will just use the standard

margin requirements for the positions.

FTSE 100 EXAMPLES

Let’s look at two FTSE 100 examples. We will say you want to

open a position risking £10 per point (spread betting) or one contract (CFD).

For our second example we will look at a position risking £2 per point (spread

betting) or one mini-contract (CFD).

The simplified sum we use is:

Risk X Current Market Level X Margin Factor

So for the FTSE 100 examples:

10 X 7220 (around the current level on 20th Feb)

X 0.9% (Your broker will display their margin factor for each market)

= £649.80

That is what needs to be in your account to cover the trade

– basically it is what your broker uses as a deposit to secure the use of the

leverage. If you took another trade at the exact same level with the same risk,

you would then need £1,299.60 etc.

Our second example would be:

2 X 7220 X 0.9% = £129.96

It is important to note here also, that these totals are not

your risk when calculating say your 1% risk for entering a trade. Just because

my margin is £129.96, does not mean that I am not planning on exiting at a

minus £40 loss, which would be a 1% risk on a £4,000 account. If my stop is set

at the £40 loss level, my risk is £40, not the margin amount.

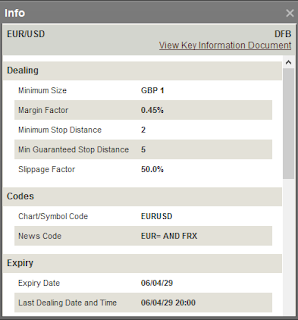

Now let’s do the math on the same position on EUR/USD which

has a margin factor of 0.45%

EURUSD EXAMPLES

10 X 13,345 (around the current level on 20th

Feb) X 0.45% = £600.53

2 X 13,345 X 0.45% = £120.10

So, what we can see, is that currently you really don’t need

a lot of money to open positions. But what most people see is the ability to

make much larger returns in terms of their investment. The other side of the

coin is that the losses can also happen very quickly. You can be risking huge

portions of your account on trades and within a matter of minutes be left with

nothing. The gambling warnings that every broker displays are not there

randomly. They are there because a very high portion of people gamble their

money away very very quickly in trading.

Let’s now look at the same examples, but with a new 1:30

leverage limit that is likely going to come into force. That will equate to

roughly 3.33%.

FTSE 100 EXAMPLES

10 X 7220 X 3.33% = £2,404.26

2 X 7220 X 3.33% = £480.52

So, now we have much bigger numbers. But, as long as you are

following good money management, the changes really shouldn’t scare you at all.

Especially not if you are a day trader. What it will also do, is FORCE people

to use much better money management and keep people who can’t afford to lose

the money off of the charts. I must stress here, I in NO WAY agree with the

changes and think adults should make their own free choices. However, you have

to take into account the positives. If you had heard as many horror stories as

I have of people losing their pensions and life-savings, you would understand

where I am coming from. Sometimes safety nets DO help.

If we look at the widely accepted ‘safe’ level of money

management, it suggests only ever risking 1% of your account on any one trade.

Now let’s say at £10 per point on the FTSE 100 you are

risking 12 points – which is an average sized stop for me day trading. We will

also use this example for the £2 per point risk.

That means you are risking £120, which means you should have

a £12,000 account. For the second example you are risking £24 and should have a

£2,400 account.

As you can see, neither of these are hampered by the new

leverage proposals. You would need to either be in 5 trades at once, or risking

way too high in proportion to your trading account for it to start impacting

you. This is where it may hurt swing traders. If you usually have 5 – 10

positions open at once, that is going to become very difficult to do without

reducing risk drastically.

For EURUSD, using the same examples but with a similar 12-point

stop –

EURUSD EXAMPLES

10 X 13,345 X 3.33% = £4,443.89

2 X 13,345 X 3.33% = £888.78

Your risk is exactly the same in both examples, and again

the new leverage regulations do not hamper your trading. Even after multiple

losses in a row, you STILL have the ability to trade at your 1% risk without

adjustments. Even if you are risking 2% per trade, it does not hurt your

trading approach.

So, the likelihood is that the new leverage regulations WILL

come into force. I do not in any way expect the emails of us retail traders to

change the proposals. However, it isn’t something you should fear as a trader

on the worry that it will snuff you out of doing something you enjoy. For us

day traders certainly, and those using good money management, we will be able

to continue as normal. It will also force beginners to use better money

management which is no bad thing.

So, the likelihood is that the new leverage regulations WILL

come into force. I do not in any way expect the emails of us retail traders to

change the proposals. However, it isn’t something you should fear as a trader

on the worry that it will snuff you out of doing something you enjoy. For us

day traders certainly, and those using good money management, we will be able

to continue as normal. It will also force beginners to use better money

management which is no bad thing.

I hope you’ve all had a great trading week!

Thanks for writing this James. Personally I have had numerous prompts to respond to ESMA directly from brokerage firms, but I havent really understood the implications of the proposed changes.

ReplyDeleteAfter reading your blog post I cant help but agree with you that the changes would be a good thing. Luckily, I have yet to blow up an account but know many people who have. If they could have been saved by these changes then I cant help think they would welcome them too.

Now I know the implications for me I will be asking my broker for a chance to win a free ipad before sending any emails for them.

Hope you're well Greg. They wonder why the changes are coming and then as you say, in the next breath they offer people ipads and laptops if they can make the most gain in a few months. All that does is encourage gambling and over trading. The more people trade, the more spread payments the broker gets!

DeleteInteresting read, looks like it doesn't affect us at all as the margin levels are much lower than our 1 % account size anyway (like you said)!

ReplyDeleteThanks James.

Thanks Oli. Yes, fine for us day traders!

Delete